ABC: who are Verra and Gold Standard? Why do they matter?

An overview of the key carbon registries

If you’ve started to explore the voluntary carbon market (VCM) world, you might have heard of verifiers like Verra. Or Gold Standard. Or maybe even the American Carbon Registry. If you know all about who/what these organisations are and what they do, feel free to skip the rest of this. But if not, here’s a quick primer.

But first, why do we need standards and verifiers?

The VCM is growing rapidly – as per McKinsey, “demand for carbon credits could increase by a factor of 15 or more by 2030 and by a factor of up to 100 by 2050. Overall, the market for carbon credits could be worth upward of $50 billion in 2030.”

This is a lot of money that could be misused or misspent. And historically, the VCM has had issues with misrepresentation and straight-up harm (like companies generating extra tons of extremely harmful refrigerant to earn profit from destroying it). Therefore, it seems that this is a market in desperate need of some policing.

You can think about the early days of the stock market as a similar parallel. Before the great crash of 1929, there was very limited oversight, leading to abundant frauds and scams. However, over time the market gained more oversight and structure through public bodies such as the SEC in the US, and private rating agencies like Standard and Poor’s and Moody’s, leading to a decrease in fraud and inconsistencies between investments.

In the VCM, this is a role played today by Verra and its peers, of whom more in a moment.

What do carbon standards actually do?

At the core, standards and verifiers set the rules of the game of carbon credits - they define such key concepts as additionality, permanence, leakage etc.

They do this in two ways:

establishing a standard – these are the base rules set that define how projects are structured, verified and validated

a standard usually incorporates a variety of methodologies, which are specific rules for a particular type of credit or project

maintaining a registry – this helps track all the projects operating under a given standard, how many credits they’ve been issued, who bought and retired them etc.

By deciding what limitations projects need to abide by, carbon standards/registries theoretically help ensure that only high-quality projects reach buyers. This brings us to the next point.

Where do carbon standards get their “license to operate”? (i.e. who put them in charge?)

In short – they get it from buyers. Key carbon credit purchasers (such as large companies) want a guarantee that what they are buying is in fact beneficial to the planet. Since it would be immensely time-consuming for them to do background research on each project (checking for additionality and permanence, as well as more mundane things like whether the landowners have legal right to do their projects), they essentially outsource this work to the likes of Verra. By buying a Verra- or Gold Standard-stamped credit, buyers can be reasonably sure that these projects have passed at least a minimum quality threshold and are not pure scams.

So… who exactly are these standard-setting verifiers you speak of?

There are four main international standard bodies (in addition to local players like the Woodland Carbon Code in the UK). Here’s who you need to know if you plan to transact in this market:

Verra

Example of a Verra tweet. Source: Twitter.com

First, we have Verra – a US-headquartered non-profit organisation that is also the largest player in the market by transacted volumes. Verra’s standard is called the VCS (Verified Carbon Standard) and it issues credits known as VCUs (Verified Carbon Units). Last year, 52% of all VCUs issued came from projects classified as Nature-based solutions (this includes forestry). In addition, Verra runs a variety of other programs around other areas relevant to the broader sustainability market, but these are less relevant to VCUs specifically.

In 2021, Verra issued 295M VCUs, representing 83% of the total issued certified credit tons last year. Verra has 1800+ registered projects, which you can browse in their public registry.

Gold Standard

Next in size is Gold Standard, another non-profit, but based in Switzerland. Their speciality is focusing on co-benefits and the social & community impacts of carbon projects. With 44M credits issued last year, they are a fraction of Verra’s size. However, Gold Standard was founded by WWF (now known as the World Wide Fund for Nature), giving it automatic credibility in the eyes of buyers. Unlike Verra, GS has proportionally fewer Nature-based solutions projects listed (only 4% of the credits they issued last year fall into that category). You can view Gold Standard’s registry here.

American Carbon Registry

Third in the list is American Carbon Registry (commonly known as ACR) - the first private registry in the world for voluntary carbon markets. ACR is geographically focused on the Americas, including Canada and LATAM. Operating since 1996, ACR has seen the market’s ups and downs - but in recent years, its growth has paled next to the more aggressive expansion experienced by Verra and GS, with only 9M credits issued in 2021. ACR’s public registry is available here.

Climate Action Reserve

Our quartet of carbon registries is rounded out by Climate Action Reserve (CAR), a primarily US-focused standard. CAR grew out of a database created by the state of California. CAR credits can also be transferred to VCS (remember, that’s the standard managed by Verra!), so CAR-issued credits can be converted into VCUs. You can see CAR’s public registry here.

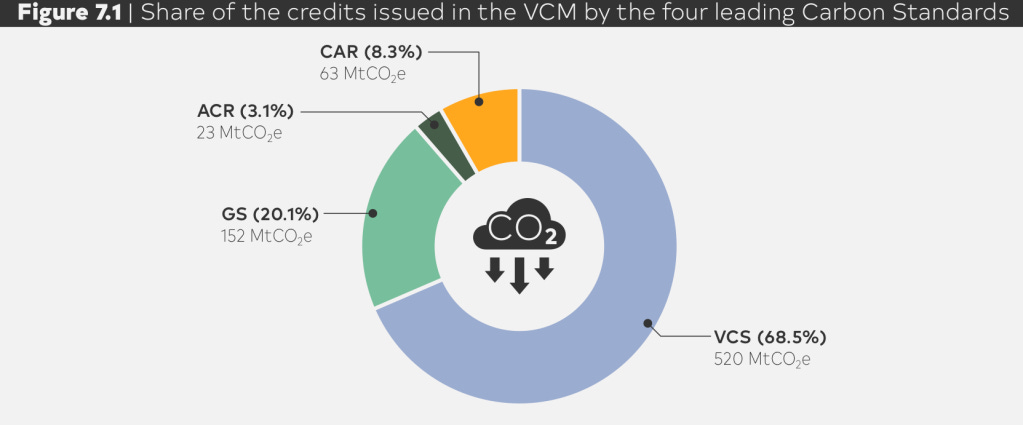

Relative market share of the 4 main registries as of 2018. Image courtesy of vcmprimer.org

Looking to the future

Given the amount of investment and new players emerging in the voluntary carbon space, it’s hard to imagine that the carbon standard and registry world is unchanged 5 years from now. Where exactly will it go? This is hard to project, but here are a few potential scenarios:

1. Fragmentation

New standards emerge to tackle specific types of credits, driving more volume through verifiers not listed above. Examples: Puro.earth (focused on biochar, geological storage and built materials), MoorFutures (focused on peatland rewetting).

2. Digitalisation/automation through remote MRV (monitoring, reporting and verification)

Digital verification methods evolve to be so advanced that 3rd-party verification becomes less relevant – for example, close to real-time tracking of afforestation projects, which allows buyers to see the status of the projects they invested in through webcams or frequently updated satellite imagery.

3. Decentralisation through blockchain (ReFi)

As crypto-based solutions get exceedingly sophisticated, the need for centralised 3rd-party verifiers might decrease as verification moves to smart contracts. Players like Klima DAO, Flow Carbon and Celo are trying to tackle this, but so far, they are all still working in conjunction with the main four verifiers. However, the future of carbon credit certification might well be Regenerative Finance (better known as ReFi). More on that in the future!

KlimaDAO, one of the original key players in the ReFi world. Source: Twitter.com