Key headlines from December - Verra’s ARR methodology earns ICVCM approval, nature-based credits surge, and Arbonics launches a first-in-market tool for Impact Forestry

Monthly newsletter on news from the New Forest Economy

Welcome to Arbonics’ monthly roundup of news relevant to forests, the voluntary carbon markets, and climate solutions more broadly. Bringing you the latest that catches our eye - as well as our own take on the news.

Verra’s VM0047 ARR methodology receives ICVCM’s approval

Verra’s VM0047 methodology for Afforestation, Reforestation, and Revegetation (ARR) projects received Core Carbon Principles (CCP) approval from the Integrity Council for the Voluntary Carbon Market (ICVCM).

👉 CCP-Eligible status means that a programme meets rigorous Core Carbon Principles standards for things like governance, transparency, accurate emissions accounting, and sustainable development safeguards.

Projects under VM0047 (like ours!) will carry the CCP label, providing buyers with assurance that they are investing in scientifically-robust and high-integrity projects.

💡 Arbonics’ take:

This is a big step forward for forestry solutions—and for Arbonics specifically, as our afforestation project falls under this innovative methodology. Labels like the CCP are crucial in the voluntary carbon market, where buyers need clarity about which solutions deliver genuine and measurable climate impact.

We are proud to operate under this methodology and look forward to being one of the first projects to achieve registration, proving that afforestation can be a high-quality, scientific, and scalable solution for carbon removal.

Arbonics first to market with Impact Forestry Assessment

In December, we launched our Carbon Opportunity Assessment (COA) tool for Impact Forestry, the first of its kind designed to help landowners evaluate the environmental and economic potential of mature forests.

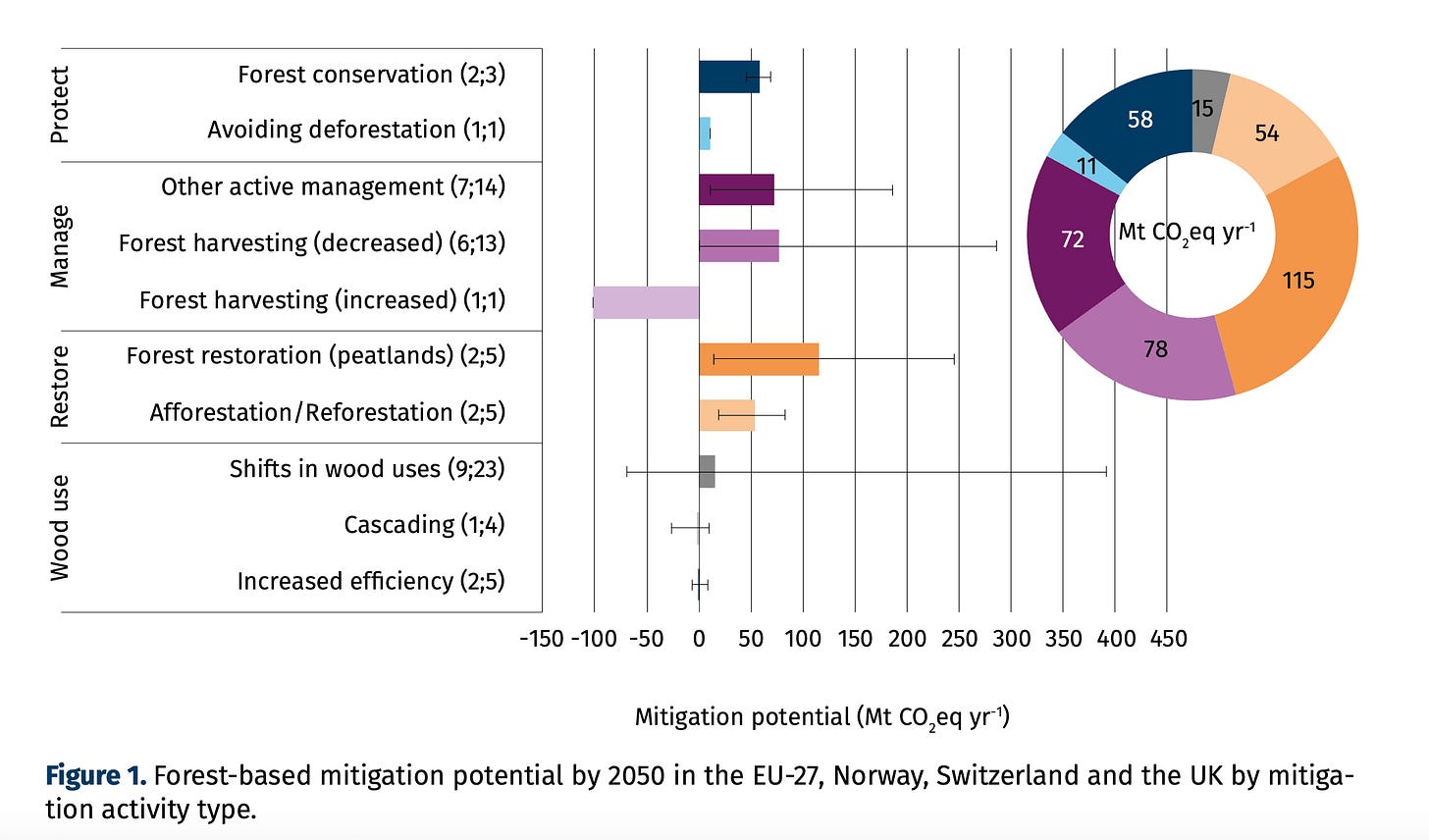

👉 Improved forest management and conservation could sequester 208 million tonnes of carbon by 2050.

With Impact Forestry, it is our goal to tap into this potential and create resilient forests where biodiversity and carbon are managed in a balanced way.

Figure 1: Forest-based climate mitigation potential (Mt CO2eq yr-1) by 2050 in the EU. Source.

An adaption of our original tool for afforestation, the COA uses more than 50 data layers to evaluate project eligibility, assessing:

Land restrictions, including existing preservation or nature restoration initiatives

Expected growth patterns for on-site species to confirm their ability to grow throughout the 40-year project period

Potential risks to specific species or habitats, such as spruce bark beetle attacks, to ensure the project’s long-term viability

These insights are compiled into a report, enabling landowners to make informed decisions about which areas to include in our project, considering factors such as timber value, harvesting costs, aesthetic appeal, and more.

Click here for an overview of our technology.

Figure 2: Arbonics’ Carbon Opportunity Assessment tool provides landowners with a comprehensive analysis of their land, helping them assess their forest's suitability for an Impact Forestry project.

Nature-based credits drive November surge in Xpansiv’s CBL trading volume

Nature-based solutions made headlines in December, fuelled by a surge in trading volumes during the previous month. Activity on Xpansiv’s CBL exchange nearly doubled month-over-month, driven by a strong preference for high-quality, nature-based credits.By mid-December, more than 2 million tonnes of carbon credits had been traded, accounting for 16% of the year’s total transactions.

Over 60,000 recent vintage Asian reforestation credits were traded, with prices ranging between $25.00 and $42.00. Meanwhile, prices for credits from lower-quality sectors like energy and industrial waste fell sharply— signalling a clear preference for high-quality projects.

It’s important to note that this data reflects activity in the spot market only and does not provide insight into offtakes or committed volumes.

💡 Arbonics’ take:

👉 This shift is exactly what the voluntary carbon market needs to drive real climate action. And while it’s positive, it’s definitely not surprising. The market’s evolution is a response to growing demands for transparency, accountability, and real impact. Buyers are becoming more discerning, investing in projects that deliver measurable, science-backed results. This trend reinforces what we’ve always believed at Arbonics: high-quality solutions are essential for meeting global climate goals.

Isometric earns triple approval from ICVCM, CORSIA And ICROA

Isometric is one of the first carbon registries to have secured approvals from ICROA, CORSIA, and ICVCM within the same year, a testament to their rigorous, science-driven approach.

Throughout the year, Isometric developed a number of protocols across various carbon removal methods, including nature-based solutions like reforestation. Their Science Network, with over 200 members, has played a key role in shaping these methodologies, ensuring they are rooted in best practices.

💡 Arbonics’ take:

👉 It is great to see Isometric’s focus on quality and transparency recognised by these leading verification bodies. The ICVCM approval enables Isometric to issue credits under the highly-regarded Core Carbon Principles (CCP) label, providing buyers with a trusted benchmark for quality.

We are pleased to have collaborated with Isometric on their Reforestation Carbon Removal Protocol last year, and look forward to seeing what they achieve next.

Thanks for reading! Let us know what you think by replying to this email (or hello@arbonics.com).